Salt, Basis and Lxme: What's the common thread?

A look at some apps that help women navigate personal finance and investment decisions.

Written by Kajal Iyer

Investments and financial management are not conversations women have growing up. In fact, it is generally discouraged with the dismissive – ye sab shaadi ke baad kar lena (do all this after you are married); the assumption being that after the father, it will be the husband who takes care of finances.

But as more and more women have started earning and living on their own, there is a need for financial knowledge and the freedom that could come with it. Traditional investment advisors too tend to have a bias when women approach them. So women sometimes feel left on their own. As per a report in the Economic Times, women spend around 2 hours on average per month on finance apps.

So I wanted to call out some apps which have been designed with financial empowerment of women in mind.

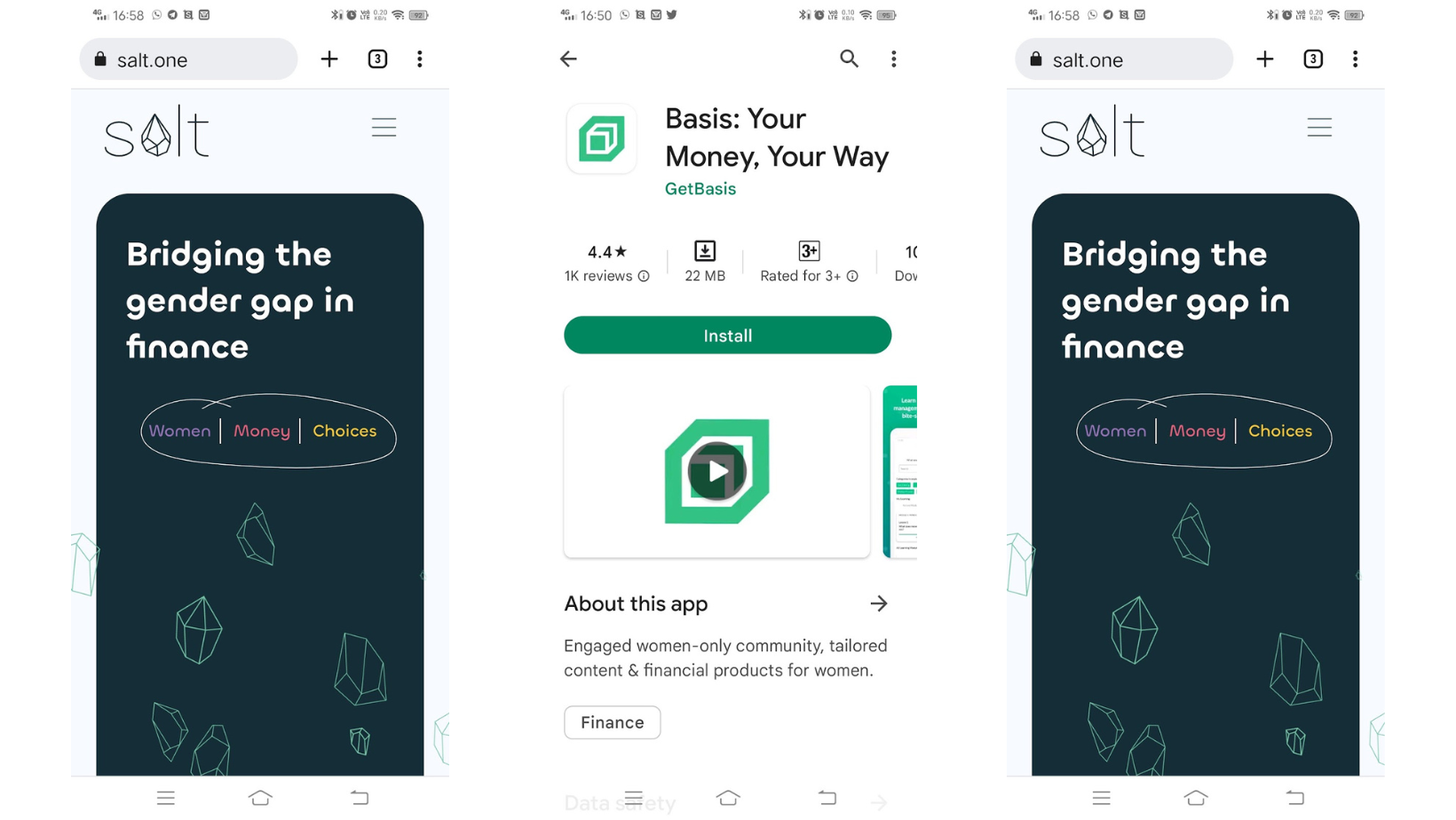

SALT - mysaltapp

The Salt web app initially assesses your finance personality with a simple quiz to help tailor your experience on the app. This is a bit like a Myers-Brigg test, only with respect to getting to know your spending and investment habits. Once you take the test you could end up knowing you are a Cautious Cabbage, A Discerning Donut or Anxious Artichoke. Based on this financial personality assessment the app gives you advice on the best financial path or what the founders (all women) call Money Map for you. This will help you understand your investment needs and how to take them forward.

Basis

Another woman-led startup, Basis has two purposes – Education and Investment oriented. The app has a tie-up with 5 fund managers. When the user inputs their financial goals/needs along with some basic data, the app analyses them to show the best investment path. The platform allows for investment in tax savings, for specific financial goals and general savings. The app also helps in planning for emergency expenses.

LXME

Named after the Hindu Goddess of Wealth, Laxmi, this app is backed by Anand Rathi investments. The LXME app boasts of offering women opportunities to earn, save and insure and invest. Since it is backed by a noted fund management firm, it offers many products to women. The app also has financial learning modules. An interesting feature of the app is the LXME community where like-minded women can discuss their financial problems on a forum.

It is worth noting here that many of the financial apps in the market are geared towards Gen Z urban women as of now. Very few have ventured into credit and investment education for rural women yet. But never say never, right?